Group Health Insurance

Health Insurance plans come in various classifications for every single organisation and group health

insurances. The main intent of a Group Health Insurance plan is to provide risk coverage

to people belonging to a same group.Companies often use the group health insurance plan

as a tool to improve retention ratio in their organisations. This helps the company to

instill confidence amongst their employees which in return helps the company to extract

more out of their employees. Usually, majority of the companies offer group health

insurance plan to establish and offer protection to the employees and their family

members, suffered in the business organisation. For employees, it is regarded as an

essential requirement which is also offered with more benefit to the

employee.

This kind of policy is generally provided by:

1. An employer to the employee

2. Banks to their Credit Card Holders or Account Holders

3. Clubs or Gyms

4. Any Corporate or Organisations

The size of the group and premium payable may vary from organisation to organi-sation,

as it depends on the nature of cover and the demographic composition of the group size.

However, the pricing of such group health insurance plans are discounted in comparison

with retail health insurances.

What is Covered?

A group health insurance policy is typically more enhanced than a retail

health insurance cover. It can be tailor made to suit the requirement of

your group. Below are the various commonly opted cover:

- In hospitalisation expenses due to Sickness or

Accidents

- Including Room, boarding Expenses as provided by the Hospital / Nursing Home;

- Nursing Expenses;

- Surgeon, Anesthetist, Medical Practitioner, Consultants, Specialist Fees;

- Anesthesia, blood, Oxygen, Operation theatre Charges, Surgical Appliances, Medi-cines and drugs, diagnostic Materials and X-Ray, dialysis, Chemotherapy

- Pre Hospitalization Expenses

- Post Hospitalization Expenses

- Domiciliary Hospitalization Expenses

- Day Care Treatments

- Maternity Expenses

- New Born Cover

- Dental Treatments

- Organ Donor Expenses

- Domicilary Treatment

- Cover 19 Cover

- OPD Expenses

- No Waiting Period for Pre Existing Health Conditions and Exclusion Diseases.

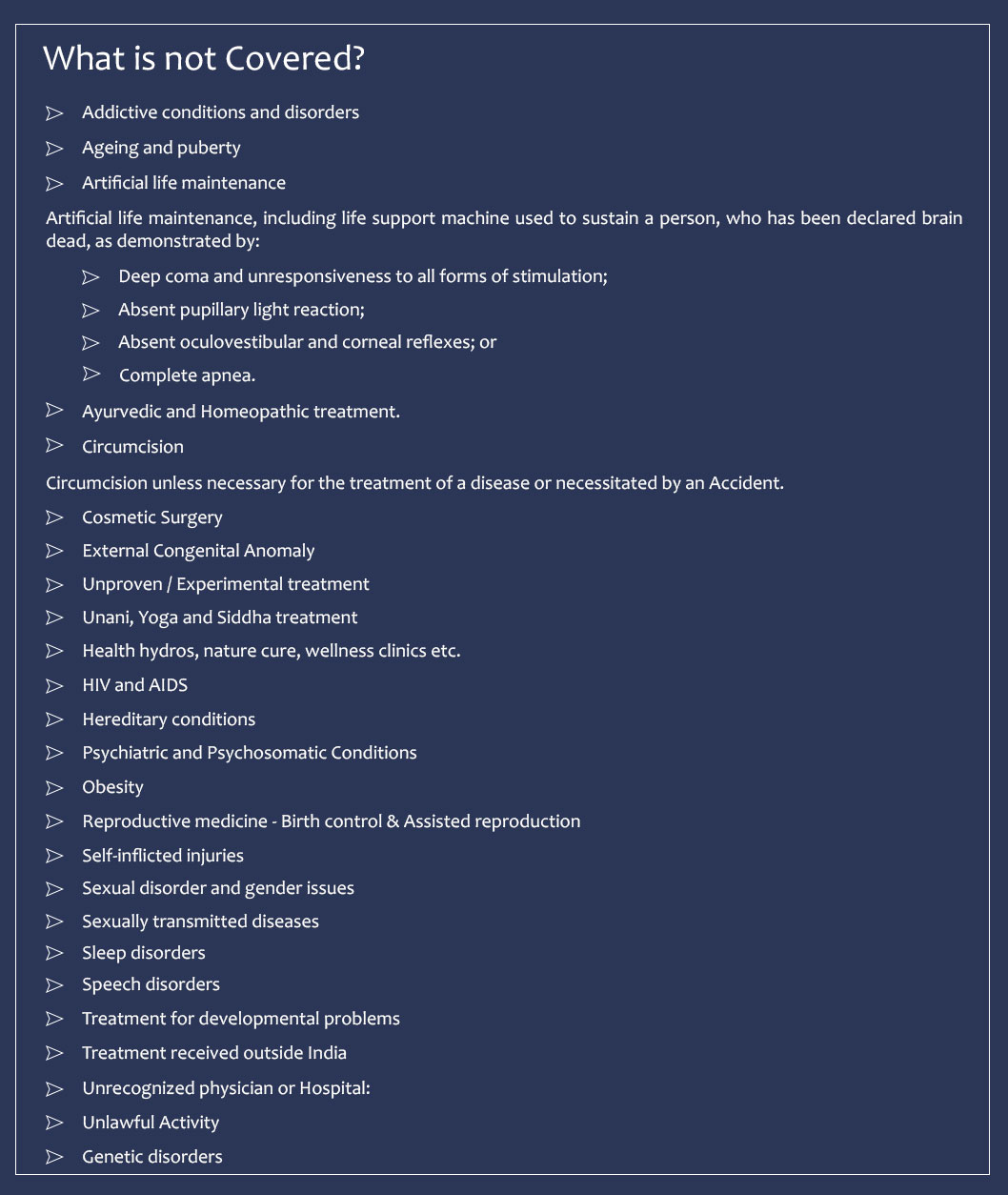

What is not covered?

- Addictive conditions and disorders

- Ageing and puberty

- Artificial life maintenance

- Deep coma and unresponsiveness to all forms of stimulation;

- Absent pupillary light reaction;

- Absent oculovestibular and corneal reflexes; or

- Complete apnea.

- Ayurvedic and Homeopathic treatment.

- Circumcision

- Cosmetic Surgery

- External Congenital Anomaly

- Unproven / Experimental treatment

- Unani, Yoga and Siddha treatment

- Health hydros, nature cure, wellness clinics etc.

- HIV and AIDS

- Hereditary conditions

- Psychiatric and Psychosomatic Conditions

- Obesity

- Reproductive medicine - Birth control & Assisted reproduction

- Self-inflicted injuries

- Sexual disorder and gender issues

- Sexually transmitted diseases

- Sleep disorders

- Speech disorders

- Treatment for developmental problems

- Treatment received outside India

- Unrecognized physician or Hospital:

- Unlawful Activity

- Genetic disorders

Artificial life maintenance, including life support machine used to sustain a person, who has been declared brain dead, as demonstrated by:

Circumcision unless necessary for the treatment of a disease or necessitated by an Accident.

How To Get Claims?

- Duly filled claim form

- Original bills, receipts and discharge certificate/card from the Hospital/ Medical Practitioner. (Self attested copies of bills, receipts and Hospital discharge summary can be provided for Critical Illness or Hospital Cash claim)

- Original bills from chemists supported by proper prescription

- Original consultation notes and/or investigation test reports and payment receipts supported by prescription. (Self attested copies of bills, receipts and Hospital discharge summary can be provided for Critical Illness or Hospital Cash claim)

- Medical Practitioner's referral letter advising Hospitalisation in non-accident cases.

- Details of any other insurance policy that may respond to the claim

- First Information Report (FIR) & Panchnama/Medico Legal Certificate for medico-legal cases. (If Applicable)